How the Community Reinvestment Act Helps Denver Homebuyers & Homeowners

How the Community Reinvestment Act Helps Colorado Homebuyers Save 1.75%

(And how to find out if your future home qualifies)

If you’re buying a home in the Denver Metro area, there’s a little-known program that could save you thousands—and no, it’s not some too-good-to-be-true ad. It’s the Community Reinvestment Act (CRA), a federal policy that’s been around since the late ’70s, but is more relevant than ever in today’s housing market.

What is the CRA?

The Community Reinvestment Act was created to ensure banks meet the credit needs of the neighborhoods they serve—especially in low- and moderate-income areas. It encourages lenders to offer better rates and special financing options to help expand access to homeownership in communities that have historically been overlooked.

What that means for you? If the home you’re buying is in a CRA-eligible area, you might qualify for lower interest rates, reduced fees, or even a rebate of up to 1.75% off your loan amount. That’s real money back in your pocket.

How does it work in the Denver Metro area?

Several neighborhoods across the Denver Metro region are CRA-designated. These include pockets in cities like Aurora, Lakewood, Arvada, Northglenn, and even parts of Denver proper. Lenders partnered with CRA programs may offer you significant savings if you’re purchasing in these zones—no income restrictions required for many programs.

This isn’t just for first-time buyers either. Some programs are available to repeat buyers or those refinancing in qualified areas.

How to find out if a home is CRA-eligible

The easiest way to check if a property qualifies for CRA benefits? Ask us—we’re happy to run the address for you and walk you through the results.

But if you’re the kind of buyer who likes to dig into things on your own (we see you 👀), here’s how you can check eligibility using one of the most reliable public tools:

Step-by-step instructions:

-

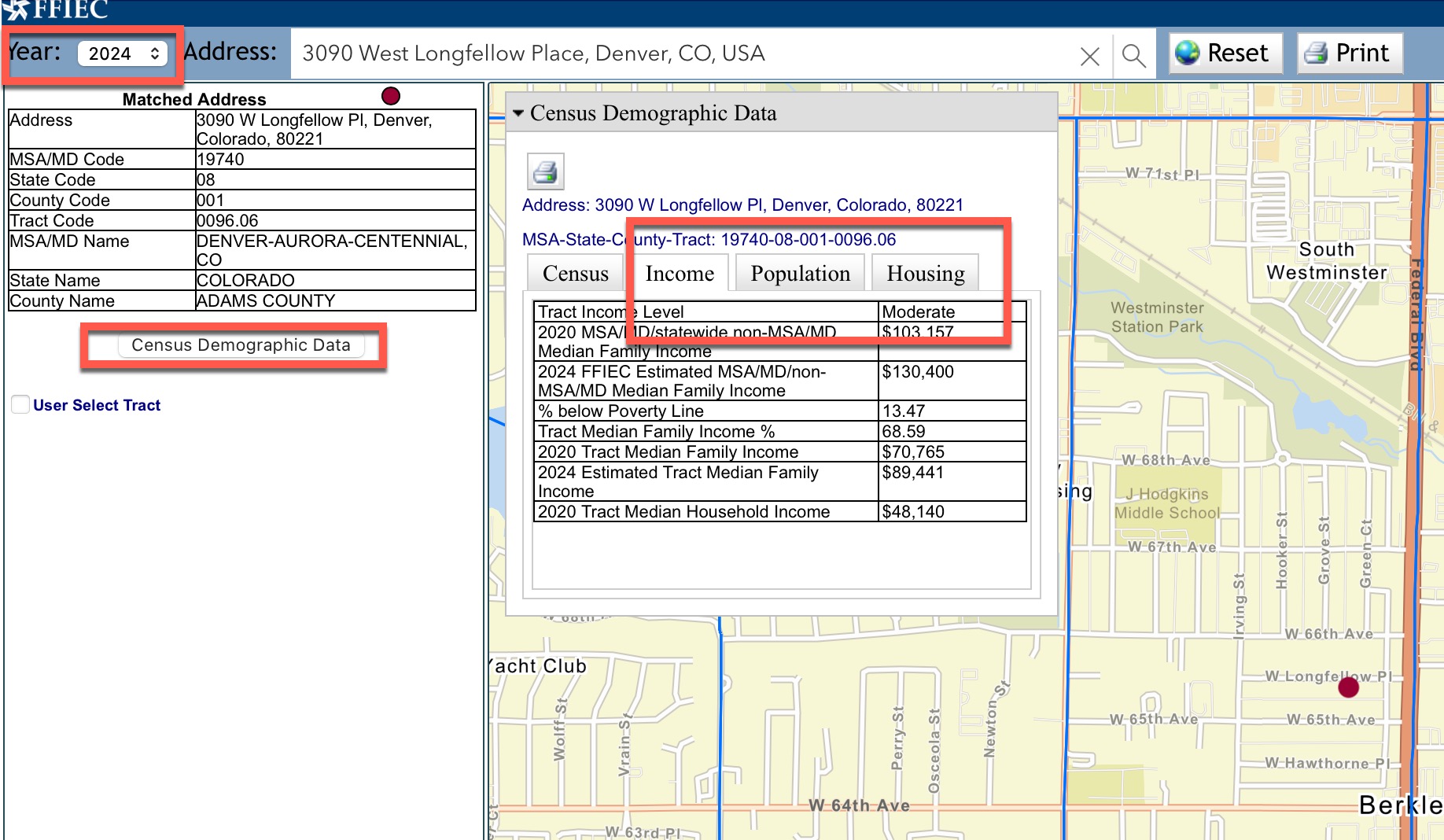

Go to the FFIEC Geocoding System

This is the official tool used to determine CRA-eligible areas. You can find it here:

-

-

Fill out the full address of the home you’re interested in, including street, city, state, and ZIP code.

-

Click the Search button.

-

Enter the property address

-

-

-

You’ll see a results page with details including “Tract Income Level” and “Income Classification.”

-

Look for the words Low or Moderate under “Income Level” — these are the areas where CRA benefits are typically available.

-

A designation of Middle or Upper usually means the property may not qualify—but it depends on the lender.

Review the results

-

-

Screenshot or copy the census tract number (optional but helpful)

If you’re applying through a CRA-participating lender, having that info can help speed things up.

⚠️ Keep in mind: CRA eligibility isn’t just about your income—it’s often based on the property’s location. That means you might qualify for benefits even if you make more than the area’s median income.

If this feels a bit too technical or confusing—don’t stress. We run this search all the time for our clients, and we’d be happy to check for you in a few minutes.

How much can you actually save?

Let’s say you’re buying a $500,000 home and qualify for a 1.75% lender credit through a CRA program. That’s $8,750 off your closing costs or toward buying down your interest rate.

And here’s the best part: these savings often stack with other assistance programs like down payment grants or FHA/VA loans. That can mean a lot more buying power, especially in a competitive market like Denver.

Ready to see if your dream home qualifies?

We’ll help you explore every opportunity to save—including CRA-based loan programs.

Click here to connect with Derek at ONE REAL Mortgage and start your application today.

And if you just want to chat about neighborhoods, the buying process, or how to navigate the Denver market as a first-time homebuyer—we’ve got your back.

Looking for more tools? Check out our First-Time Homebuyer Guide or explore our Relocation Tips for LGBTQ+ Families to help you feel confident every step of the way.

Categories

Recent Posts